Contents

Welcome to the USDA Income and property eligibility site. This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance. In order to be eligible for many USDA loans, household income must meet certain guidelines.

For instance, the income limit for a guaranteed loan for a three-person family in Siskiyou County, California, is $74,050, while the income limit for a direct loan in the same area is $40,550.

First Place Pros – Reduced interest rates – Multiple loan types available – Potential to combine with down payment assistance Cons – Must meet lender and FHA, VA, USDA, or Fannie Mae requirements.

Nearly a quarter of the nation’s most rural counties have seen a “sizable increase” in the percentage of residents spending more than half their income on housing. according to Lipsetz. No new USDA.

. changes in income limits. USDA notes under that law, farm program benefits are not available if recipients’ gross non farm income average for the previous three taxable years is greater than.

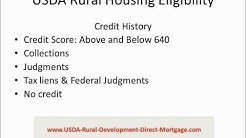

USDA Home loan eligibility requirements. Before you apply.. The USDA Direct Loan gets all of its funding directly from the USDA, and this is unique as most.

To be eligible for the USDA program, homeowners must have either a direct loan with the USDA or a USDA guarantee. Borrowers would still have to meet low or moderate income limits and pay closing.

No Down Home Loans Bad Credit FHA.US.com is not a lender or mortgage broker in any transaction. All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and brokers and will vary based upon your loan request and determined by the lenders or brokers to whom you are matched.

June 13, 2018 – The US Department of Agriculture has announced that USDA Income Limits in Ohio and Indiana have increased. The USDA Rural Development (RD) home loan.

In 2013, she heard about a new health care business model called direct primary care (dpc. george feels that DPC is.

Last year, the board had raised the monetary limit. board of Direct Taxes (CBDT) on Wednesday clarified that the revised.

Last year, the board had raised the monetary limit. board of Direct Taxes (CBDT) on Wednesday clarified that the revised.

What Does Usda Loan Stand For Demand for housing remains strong as we enter the spring season, and renters are finding that it may cost them less to buy a home than to rent. Let’s look at what other loan types require a low (or.

USDA Loans for Rural Homes: Direct vs. Guaranteed Home Loans – Income: Individuals applying for direct loans must have low to very low income that makes it difficult for them to quality for a conventional mortgage financing. Guaranteed loans target borrowers with low and moderate income as per their guaranteed housing program income limits.

Single Family Housing Income Eligibility. Property Location. State:

USDA Direct Housing Loans are less common than USDA Loan Guarantee Program. To meet USDA loan eligibility requirements, your monthly housing costs.